香港數碼港管理有限公司

2015/16

年報

127

Notes to the Financial Statements

財務報表附註

14

證券投資

(續)

(a)

持有至到期日投資

(續)

持有至到期日投資為以港元、美元及人民

幣為單位之債券,其到期日由

3

至

43

個月

不等(

2015

年:

1

至

54

個月)。分類為持有

至到期日之上市和非上市但有報價債務證

券之市值乃按債務證券場外交易之報價為

基礎。於報告期末存在之最大信貸風險是

持有至到期日投資之賬面值。

年內本公司並無將任何按攤銷成本計量之

金融資產重新歸類(

2015

年:無)。

(b)

按公允價值計入損益之投資

15

應收賬款及其他應收款項

除了為數

1,640,514

港元(

2015

年:

1,550,073

港元)之款項預計於一年後收回外,本公司

所有預付款項、按金和其他應收款項預期

可於一年內收回或確認為支出。

14 Investments in securities

(continued)

(a) Held-to-maturity investments

(continued)

The held-to-maturity investments represent bonds with

maturities ranging from 3 to 43 months (2015: 1 to 54

months) and are denominated in Hong Kong dollars, USD

and RMB. The market values of listed and unlisted but

quoted debt securities classified as held-to-maturity are

based upon the market price of the debt securities quoted

over-the-counter. The maximum exposure to credit risk

at the end of the reporting period is the carrying amount

of held-to-maturity investments.

The Company has not reclassified any financial assets

measured at amortised cost during the year (2015: Nil).

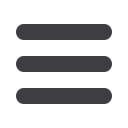

(b) Investments at fair value through profit or loss

2016

2015

HK$

HK$

港元

港元

Listed fixed interest debt securities:

上市固定利息債務證券:

• In Hong Kong

•

香港境內

83,203,222

4,849,603

• Outside Hong Kong

•

香港境外

220,538,753

290,090,949

Unlisted but quoted fixed interest

debt securities

非上市但有報價固定利息債務

證券

12,545,692

7,400,431

316,287,667

302,340,983

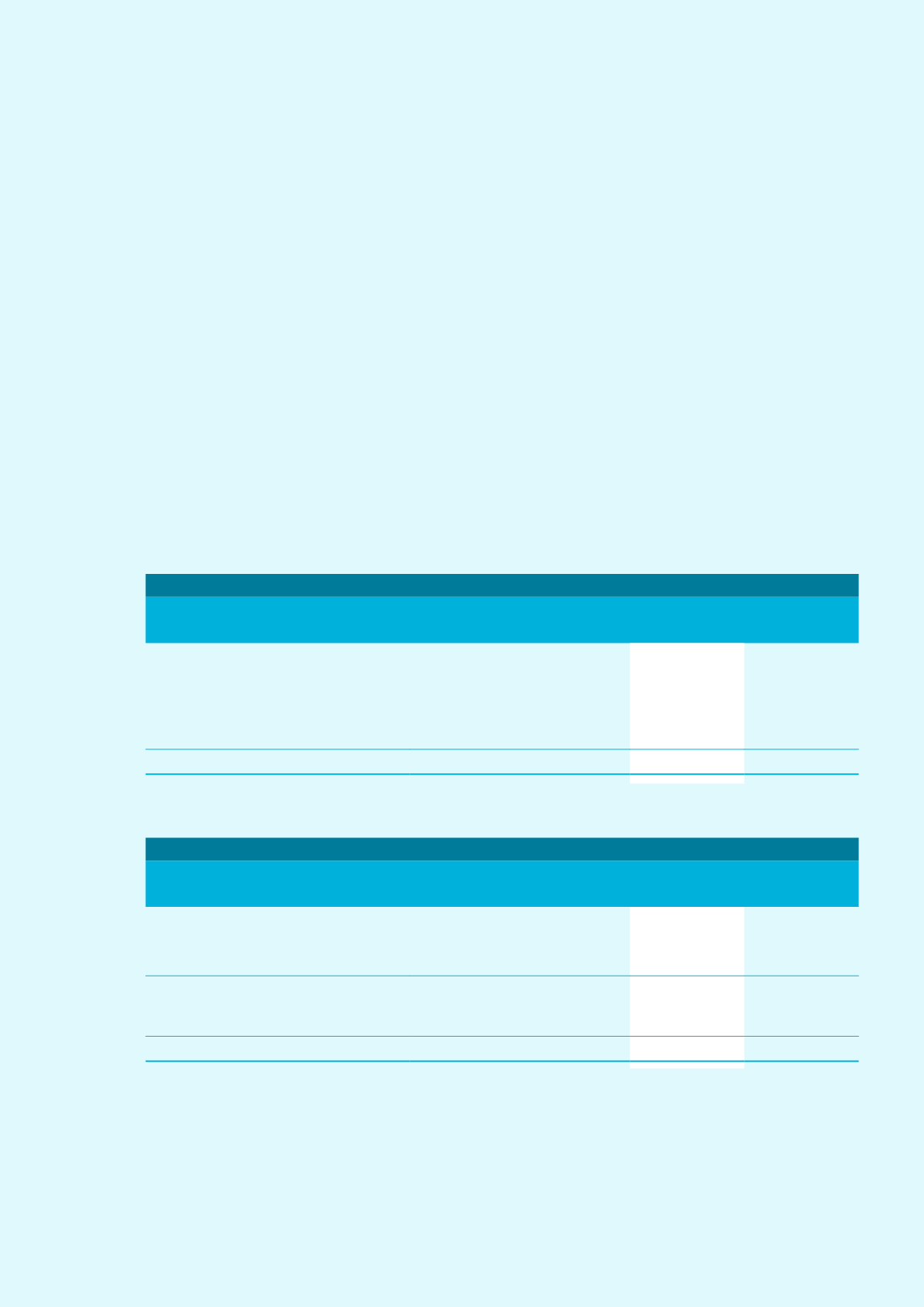

15 Trade and other receivables

2016

2015

HK$

HK$

港元

港元

Trade receivables

應收賬款

5,428,888

6,502,766

Less: Provision for impairment of

receivables (note 15(d))

減:應收賬款減值撥備

(附註

15(d)

)

(759,021)

(1,421,649)

Trade receivables — net

應收賬款-淨額

4,669,867

5,081,117

Prepayments, deposits and other

receivables

預付款項、按金和

其他應收款項

20,670,852

12,853,804

25,340,719

17,934,921

All prepayments, deposits and other receivables are

expected to be recovered or recognised as expenses by

the Company within one year, except for the amount of

HK$1,640,514 (2015: HK$1,550,073) which is expected to

be recovered after one year.